A Beginner’s Guide to Freedom with Trinity Debt Management

Is the weight of debt dragging you down? Do credit card bills pile up like Everest, and the dream of financial freedom feels as distant as Mars? You’re not alone, friend. Millions of us are scaling this same debt mountain but fear not! This guide equips you with the tools and insights to plant your flag at the peak of Debt-Free, with Trinity Debt Management as your trusty sherpa.

Trinity isn’t just another faceless debt solution; they’re your financial guide and cheerleader, offering personalized Debt Management Plans (DMPs) to slash your interest rates, streamline your payments, and carve a path towards freedom. Ditch the juggling act of multiple bills – imagine one, manageable monthly payment, paving the way to a brighter financial future.

But it doesn’t stop there! Trinity empowers you with the knowledge and skills to conquer debt for good. Learn budgeting strategies that fit your lifestyle, gain the confidence to tackle credit repair, and discover smart saving habits that build a financial fortress around your future.

Ready to ditch the debt backpack and start your ascent? Dive deeper into this guide for a comprehensive review of Trinity Debt Management’s arsenal, and take your first step towards financial freedom today!

Trinity Debt Management Review 2024: Is it legit?

Okay, just imagine this: you’re scaling your debt mountain, Trinity Debt Management’s sherpa ropes secured around your waist, and you’re finally nearing the summit – Debt-Free Peak! But before you plant your flag, you have a valid question: “Is Trinity legit?”

Absolutely! Trinity Debt Management Founded in 1994, Trinity boasts over 20 years of experience guiding fellow debt warriors like you towards financial freedom. They’re a non-profit credit counseling agency, which means they’re on your side, not lining their pockets with your hardship. Plus, they’re accredited by the National Foundation for Credit Counseling (NFCC) – a gold standard in the debt relief world.

How Does Trinity Work its Magic?

So, how exactly does Trinity become your weapon of financial liberation? Let’s delve into the arsenal they offer:

1. Debt Management Plan (DMP): Your Mastermind Strategy

Trinity’s flagship weapon is the Debt Management Plan (DMP). Think of it as a strategic battle map, guiding you towards financial liberation. Here’s how it works:

- Consolidate Your Debts: Trinity consolidates your multiple debts into a single, streamlined monthly payment. This simplifies your finances, reducing the chaos and overwhelm.

- Negotiate Lower Interest Rates: Their team of expert negotiators wields their experience like powerful swords, slashing away at high interest rates and securing you more favorable terms.

- Streamlined Payments: Say goodbye to juggling multiple bills! With Trinity, you make one convenient monthly payment, ensuring consistent progress towards your goal.

2. Budgeting and Financial Education: Equipping You for the Long Haul

Debt freedom isn’t just about a quick fix; it’s about lasting change. Trinity recognizes this, equipping you with the tools and knowledge to manage your finances wisely for the long run. This includes:

- Personalized Budgeting Plans: Their qualified counselors work with you to craft a customized budget that fits your unique needs and income.

- Financial Education Workshops: Gain valuable insights into responsible spending, debt prevention, and smart saving strategies through Trinity’s informative workshops.

- Constant Support and Guidance: You’re never alone on this journey. Trinity’s dedicated team is always available to offer support, answer your questions, and celebrate your victories along the way.

3. Credit Repair: Mending the Scars of Battle

Debt can leave scars on your credit score, hindering your future financial opportunities. Trinity understands this and offers valuable credit repair services to help you:

- Identify and Dispute Errors: They meticulously analyze your credit report, identifying and disputing any inaccuracies that may be dragging down your score.

- Build Positive Credit History: Trinity guides you on healthy credit-building practices, helping you establish a strong financial foundation for the future.

- Monitor Your Progress: Stay informed about your credit score with Trinity’s ongoing monitoring, allowing you to track your progress and celebrate milestones.

4. Beyond Debt Freedom: Building a Brighter Financial Future

Trinity’s mission extends beyond simply crushing your debt. They empower you to build a solid financial future, free from fear and anxiety. This includes:

- Retirement Planning: Start planning for your golden years early with Trinity’s expert guidance on retirement savings and investment strategies.

- Homeownership Education: Whether you dream of buying your first home or refinancing your existing one, Trinity’s resources equip you with the knowledge you need to make informed decisions.

- Financial Wellness Support: Beyond numbers, Trinity prioritizes your overall financial well-being, offering resources and support to manage stress, anxiety, and improve your relationship with money.

Breaking Free from the Chains: Your Debt-Free Future Awaits

The path to debt freedom may seem daunting, but with Trinity Debt Management by your side, it becomes a journey filled with hope, progress, and ultimately, triumph. Don’t let debt dictate your story. Take the first step, reach out to Trinity, and claim your financial freedom. Remember that you are not lonely in this battle.

Articles that may help you:

Is Trinity Debt Management Right for You? A Quick Self-Assessment

So, you’ve scaled through the “Is Trinity Legit?” section and are still pumped about conquering your debt mountain. But before you strap on your hiking boots and grab Trinity’s sherpa rope, let’s do a quick self-assessment to see if they’re the perfect climbing partner for you!

Think of it like a financial pit stop:

- Are you drowning in credit card debt, struggling to keep your head above water? If so, Trinity’s Debt Management Plans (DMPs) can be your financial life raft, consolidating your debts and slashing those punishing interest rates.

- Feeling overwhelmed by juggling multiple bills? Imagine the sweet relief of one streamlined monthly payment with a DMP! No more bill-juggling circus act, just clear progress towards Debt-Free Peak.

- Ready to ditch the debt hamster wheel for good? Trinity goes beyond quick fixes by equipping you with budgeting skills, financial education, and ongoing support to prevent future debt spirals.

If you answered “yes” to any of these, Trinity might be your ideal financial sherpa! But remember, every climber needs the right gear.

How Much Does Trinity Debt Management Cost? Demystifying the Fees

Trinity Debt Management is a non-profit organization, meaning they’re on your side, not lining their pockets with your hardship. However, they do have fees associated with their Debt Management Plans (DMPs):

- Monthly Fee: This covers their operational costs, like negotiating with creditors and providing financial education. It usually ranges from $8 to $50 per month, depending on your debt amount and state regulations. Think of it as a small investment in your financial future.

- No Upfront Fees: Unlike some debt relief companies, Trinity doesn’t charge you a hefty upfront fee to join their program. They believe in accessible solutions, not financial roadblocks.

But the good news is, the fees are often offset by the savings you get through Trinity’s DMP:

- Lower Interest Rates: Their expert negotiators slash those pesky high-interest rates, saving you money in the long run. Imagine the feeling of watching your debt shrink faster, not just your wallet!

- Streamlined Payments: No more juggling multiple bills! One convenient monthly payment to Trinity means less stress and more control over your finances.

- Reduced Late Fees: Say goodbye to those dreaded penalty charges. Trinity handles all communication with creditors, so you can focus on climbing that mountain, not worrying about debt collection calls.

Remember, the fees are an investment in your financial freedom. When you consider the potential savings and the ongoing support you receive from Trinity, it’s a small price to pay for a smoother, faster climb to Debt-Free Peak.

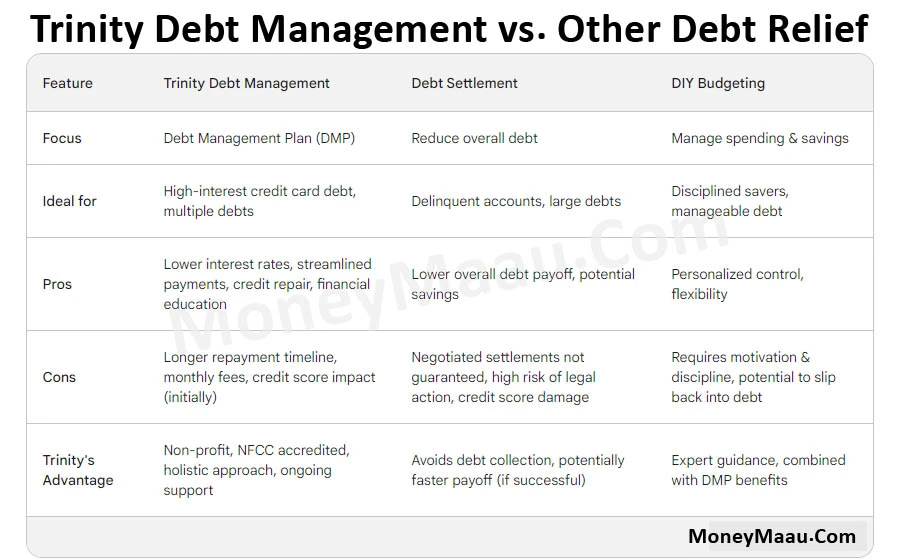

Trinity Debt Management vs. Other Debt Relief Options: A Side-by-Side Comparison

Conquering your debt mountain is an epic quest, and choosing the right path can feel like deciphering an ancient treasure map. You’ve heard whispers of Trinity Debt Management as a trusty sherpa, but what about other options like debt settlement or DIY budgeting? Don’t fret, brave adventurer! This handy comparison table is your personal decoder ring:

Conclusion:

Congratulations, fellow adventurer! You’ve reached the summit of this guide, equipped with the knowledge and tools to conquer your debt mountain. Remember, the path to Debt-Free Peak is a personal journey, and Trinity Debt Management stands ready as your guide and cheerleader.

If you’re drowning in credit card debt, struggling with multiple bills, or simply yearning for financial freedom, Trinity’s Debt Management Plans offer a clear, manageable path forward. With lower interest rates, streamlined payments, and expert support, you’ll be well on your way to planting your flag at the summit.

But this guide is just the first step. Take action! Reach out to Trinity Debt Management for a free consultation, explore their programs, and find the perfect fit for your unique financial situation.

So, share your thoughts in the comments below! Did this guide help you navigate the debt relief landscape? Have you considered Trinity as your climbing partner? Let’s spread the word and help others conquer their own debt mountains.

Remember, the power to climb lies within you. Take the first step, reach out to Trinity, and claim your Debt-Free Peak!

1 thought on “How to Become Debt-Free? Trinity Debt Management Review!”