In the vast and ever-evolving landscape of the banks in USA into the banking sector, a select group of financial powerhouses have established themselves as the frontrunners. These institutions wield enormous influence, not just within the country but also on a global scale. In this article, we delve into the captivating world of banking, exploring the Top 10 banks in USA; ranking by assets. Brace yourself for a rollercoaster ride of financial prowess, intriguing strategies, and the relentless pursuit of success. According to the reports of Federal Reserve Statistical Released on March 31, 2023, In this article we are going to see the top 10 banks in usa; by consolidated assets report

List of the Top 10 Banks in USA

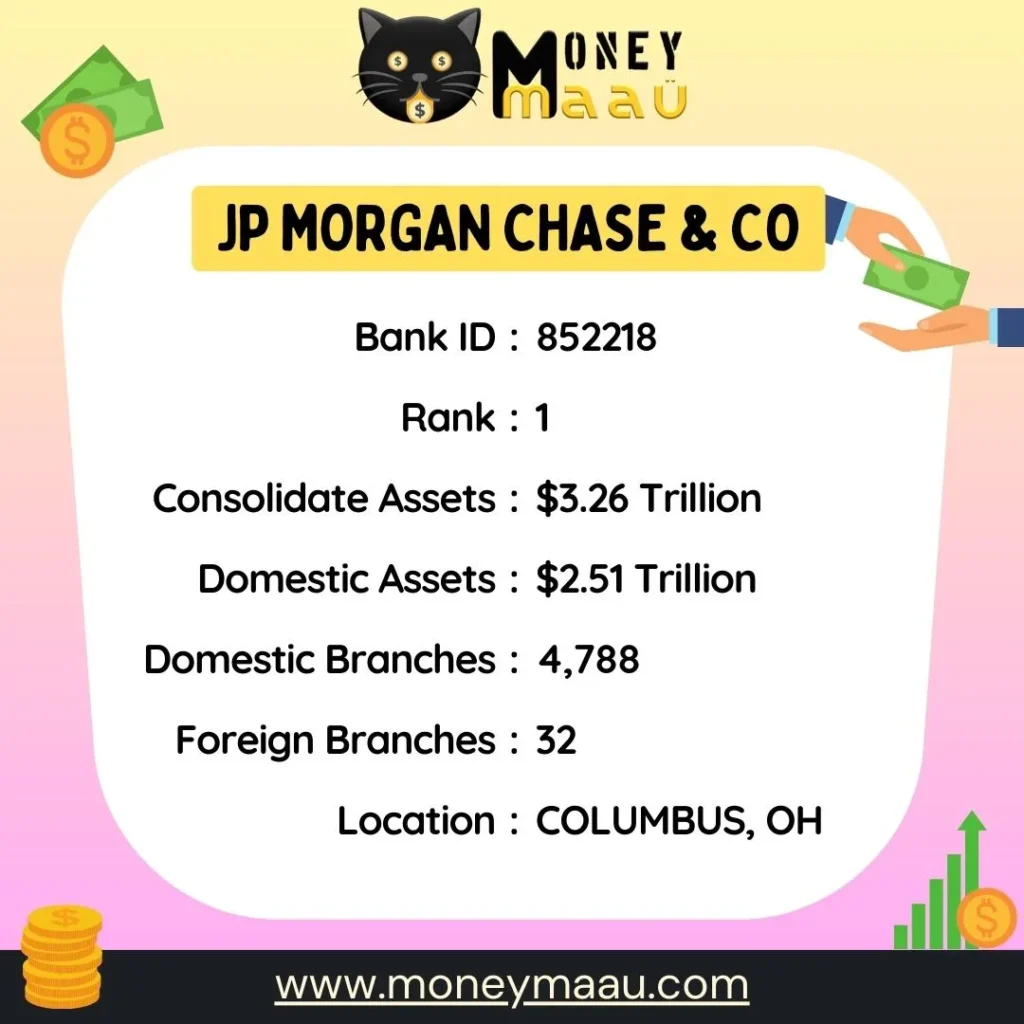

JP Morgan Chase & Co.: Shaping the Financial Landscape

No discussion whenever we discussed Top banks in USA, On top American banks would be complete without mentioning the indomitable JP Morgan Chase & Co. Armed with a formidable arsenal of assets, this financial giant has cemented its position as an industry trendsetter. From investment banking to wealth management, JP Morgan Chase & Co. leaves an indelible mark on every facet of the financial landscape, orchestrating innovation and driving progress.

Check out Stock Price : Click Here

Bank of America Corporation: Juggernauts of Wealth

At the summit of the banks in the USA hierarchy stands Bank of America Corporation. With a mind-boggling array of assets under its command, this banking behemoth exemplifies financial might. Its intricate network spans every nook and cranny of the nation, catering to the diverse needs of individuals, businesses, and institutions alike. Bank of America Corporation’s steadfast commitment to innovation and cutting-edge solutions has solidified its position as a force to be reckoned with.

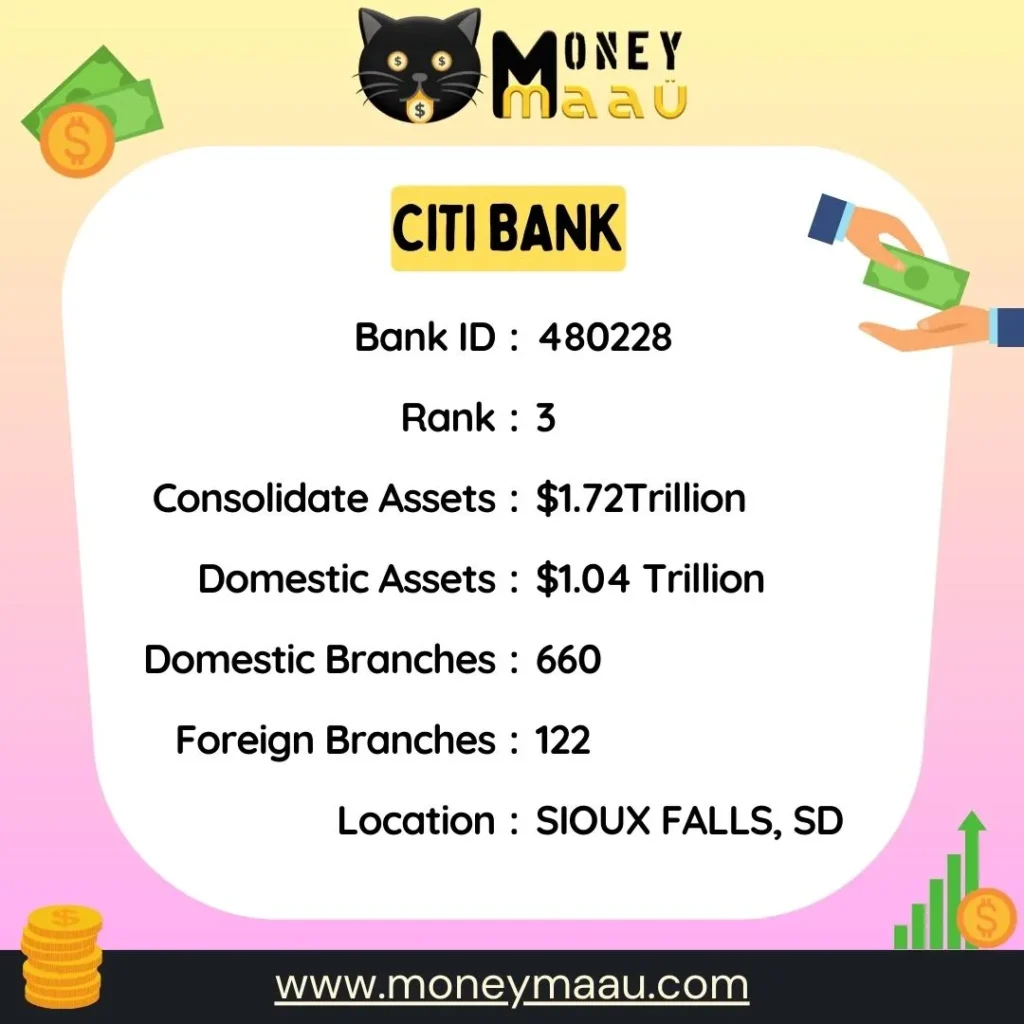

Citigroup Inc.: A Global Force of Financial Expertise

Venturing into the realm of global banking prowess, Citigroup Inc. takes the stage with a commanding presence. Renowned for its expansive international operations, this institution has successfully transcended borders to become a true global force. With its diverse range of financial services and an impressive asset portfolio, Citigroup Inc. is an undisputed player in the world of finance.

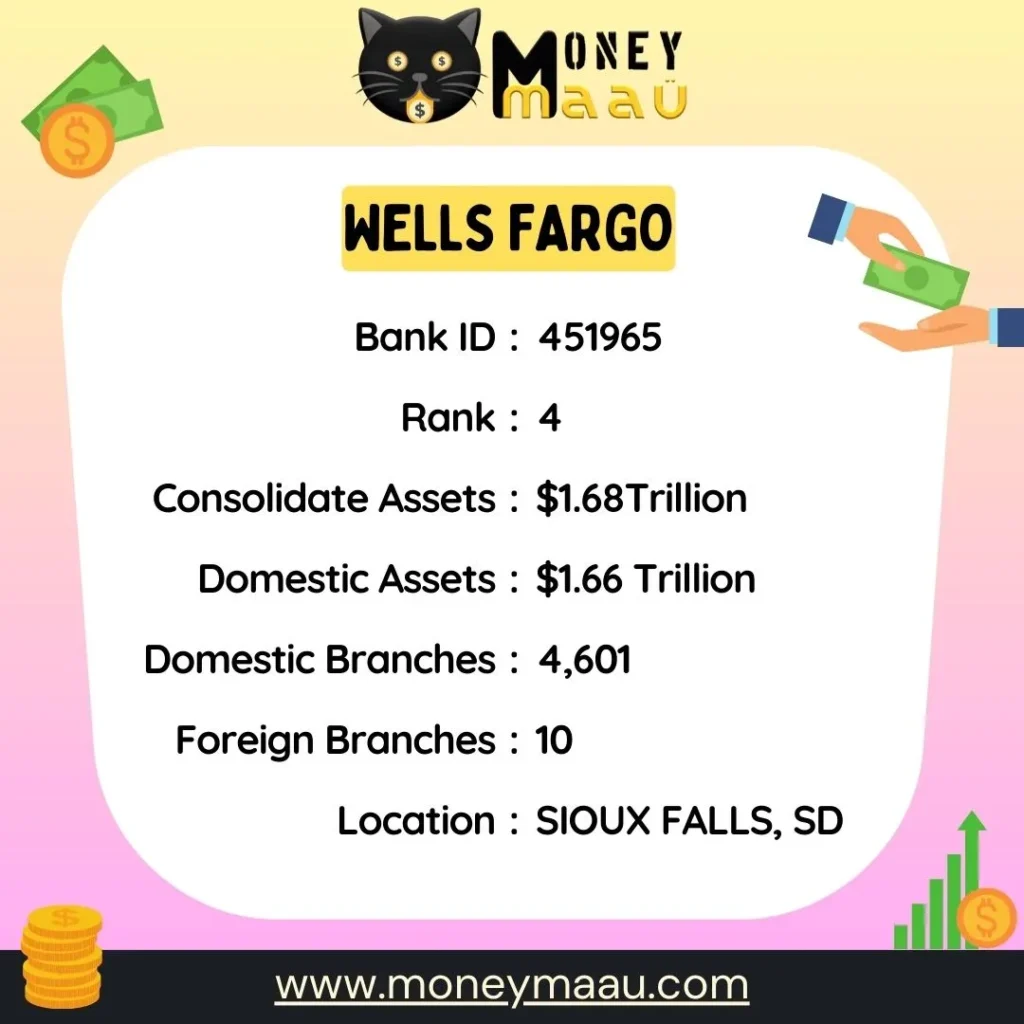

Wells Fargo & Company: A Legacy of Strength

While traversing the realm of banks in the USA, one name that resonates deeply is Wells Fargo & Company. With a rich history spanning centuries, this institution has weathered numerous storms, emerging stronger than ever. Boasting an impressive array of assets, Wells Fargo & Company continues to demonstrate resilience, adaptability, and an unwavering dedication to customer satisfaction.

U.S. Bancorp: A Pillar of Stability

In the dynamic landscape of banks in the USA, U.S. Bancorp stands tall as a bastion of stability. Balancing reliability and adaptability, this financial institution has earned the trust of countless individuals and businesses across the nation. With an impressive array of assets fueling its operations, U.S. Bancorp sets the benchmark for consistency and customer-centric banking.

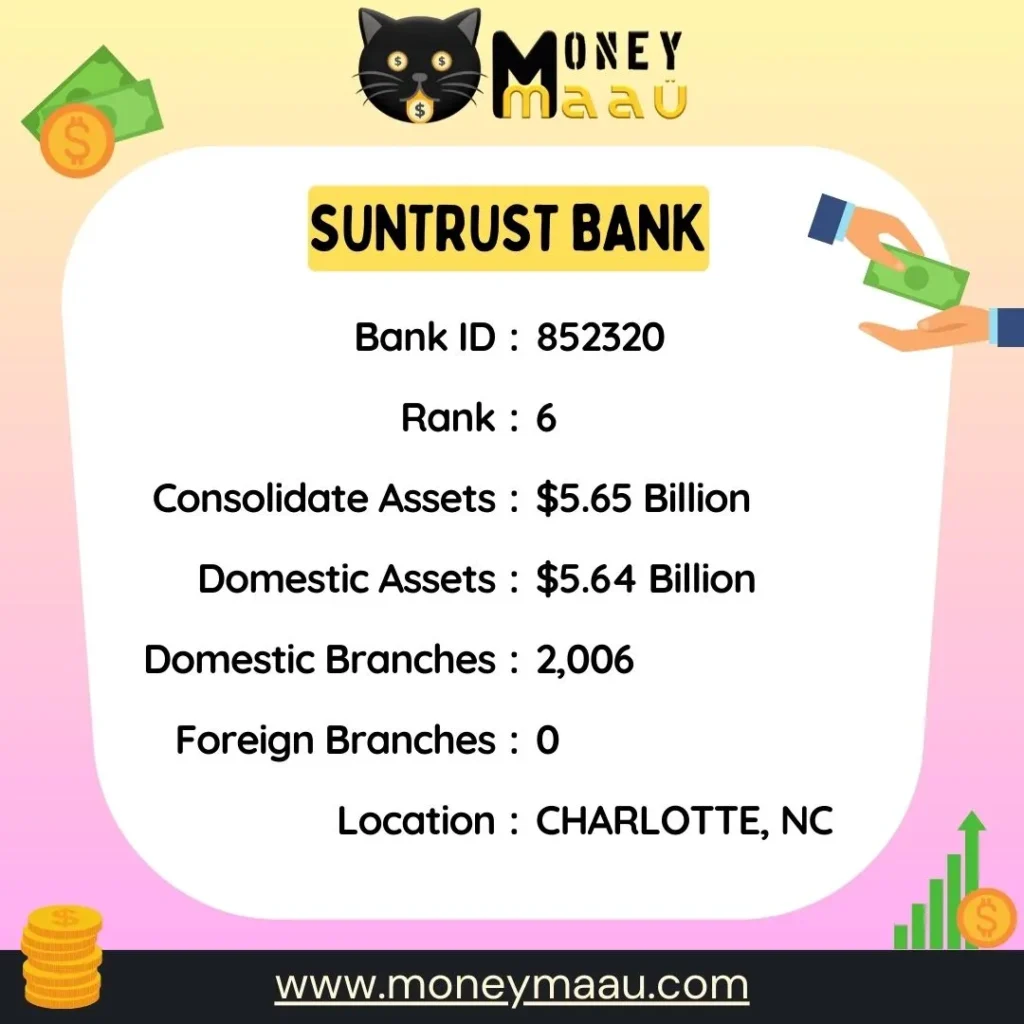

SunTrust Banks, Inc.

SunTrust Banks,Inc., now known as Truist Financial Corporation, was an American bank holding company that operated in colorful countries across the United States. The company was innovated in 1891 and had its headquarters in Atlanta, Georgia. SunTrust Banks,Inc. offered a wide range of banking and fiscal services to its guests, including banking, wealth operation, mortgage services, and marketable banking. Throughout its history, SunTrust Banks,Inc. gained a character for its commitment to client service and community involvement. In this composition, we will explore the trip and achievements of SunTrust Banks,Inc., pressing its benefactions to the fiscal assiduity and the communities it served.

PNC Financial Services Group, Inc.: A Legacy of Excellence

Rounding out our journey through the top 10 banks in the USA, we encounter the storied institution of PNC Financial Services Group, Inc. Known for its unwavering commitment to excellence, this bank has built a formidable reputation through a combination of traditional values and progressive strategies. With its significant asset holdings, PNC Financial Services Group, Inc. serves as a beacon of stability and reliability.

Goldman Sachs Group, Inc. : Traversing Boundaries

Embarking on a journey through the labyrinthine corridors of banks in the USA, we encounter the illustrious Goldman Sachs Group, Inc. Distinguished for its prowess in investment banking, this institution boasts a distinctive blend of traditional expertise and groundbreaking innovation. With an enviable asset base, Goldman Sachs Group, Inc. exemplifies the art of strategic financial management.

Capital One Financial Corporation: Empowering Possibilities

As we traverse the realm of banks in the USA prowess, we encounter the innovative force that is Capital One Financial Corporation. This institution’s unwavering commitment to technological advancement and customer convenience has revolutionized the banking experience. With its substantial assets and a bold vision for the future, Capital One Financial Corporation is reshaping the boundaries of financial possibility.

TD Group US Holdings LLC: Bridging Banking Traditions

Stepping into the realm of transnational banking, we encounter TD Group US Holdings LLC, an institution that skillfully combines the best of American and Canadian banking traditions. With a strong focus on customer-centricity and a vast asset portfolio, TD Group US Holdings LLC bridges continents, delivering top-notch financial solutions and embodying the spirit of cross-border synergy.

Conclusion

The top 10 banks in USA by assets represent the pinnacle of financial strength and influence. These institutions have successfully navigated the complexities of the banking landscape, cementing their positions as formidable powerhouses. From Bank of America Corporation’s staggering asset base to PNC Financial Services Group, Inc.’s unwavering commitment to excellence, each bank has left an indelible mark on the industry. As the financial landscape continues to evolve, these institutions will undoubtedly shape the future of banking, pushing boundaries, and driving innovation to new heights.

“Explore Stock Market Insights” : Click Here

Frequently Asked Questions

Why should I watch about the top banks in USA?

We understand that banking may not be the most instigative content, but it has a profound impact on our lives. The 10 top banks in USA play a vital part in shaping the frugality, driving fiscal growth, and impacting colorful sectors. From furnishing loans for homes and businesses to offering investment openings, these banks impact our diurnal lives more than we may realize. So, whether you are a business proprietor, an aspiring homeowner, or simply interested in the fiscal geography, keeping an eye on the top banks can give precious perceptivity and help you make informed opinions.

How are the top banks ranked by means?

The ranking of the 10 top banks in USA is generally grounded on their total means. means relate to the fiscal coffers possessed or controlled by a bank, including cash, loans, investments, and other fiscal instruments. Banks with larger asset portfolios tend to have further fiscal leverage, enabling them to offer a wider range of services, engage in strategic investments, and navigate profitable oscillations with relative stability. The ranking by means provides a shot of the size and strength of each bank and serves as a standard for assessing their influence in the assiduity.

What factors contribute to a bank’s ranking by means?

Several factors contribute to a bank’s ranking by means. These include the quantum of deposits held by the bank’s guests, the loans it has expended, investments made in securities, and other fiscal instruments. also, the bank’s accessions, combinations, and organic growth strategies also play a part in expanding its asset base. It’s worth noting that a higher ranking by means does not inescapably indicate superior fiscal performance. Other factors similar as profitability, effectiveness, and client satisfaction should also be considered when assessing a bank’s overall strength and stability.

Are the top banks in USA safe for my plutocrat?

Rest assured, the 10 top banks in USA are regulated by strict banking laws and oversight authorities. These institutions have robust threat operation practices in place to cover the interests of their guests. also, deposit accounts in these banks are ensured by the Federal Deposit Insurance Corporation( FDIC) up to a certain limit, presently set at$ 250,000 per depositor, per bank. This insurance content provides an redundant subcaste of security for your finances. still, it’s always judicious to conduct thorough exploration, read client reviews, and consider fresh factors similar as freights, services, and client support before entrusting your plutocrat to any bank.

How can I choose the right bank for my requirements?

Choosing the right bank depends on your individual requirements and preferences. Consider factors similar as the range of services offered, freights and charges, availability of branches and ATMs, online banking features, client support, and the bank’s character. It’s also helpful to assess your fiscal pretensions and determine which bank aligns stylish with your specific conditions. Comparing immolations from multiple banks, reading client witnesses, and seeking recommendations from trusted sources can help you in making an informed decision.

Flash back, each person’s fiscal requirements are unique, so take the time to estimate your options and elect a bank that aligns with your pretensions and values.

still, please feel free to reach out to us, If you have any further questions or need farther banking. We are then to help you navigate the instigative world of banking and finance.

1 thought on “How to I Find the Top 10 Banks in USA: by Assets”